Single Public Service Pension Scheme

Retirement Options

How to Retire

Calculating your Pension & Lump Sum

Enhancing your Pension

Spouses’ & Children’s Scheme

More Information

Retirement Options

There are four ways to retire from teaching under the Single Public Service Pension Scheme.

(i) Ordinary Retirement:

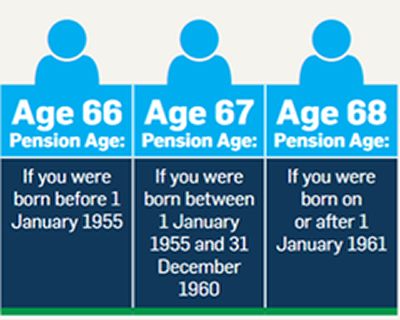

The earliest that a member of the Pension Scheme can retire without penalties, other than on medical grounds, is on the day that they become entitled to the State Contributory Pension that is funded by their PRSI contributions. The table below illustrates these ages. A member of the Pension Scheme may, however, continue to teach beyond that date but must retire, at the latest, when they reach 70 years of age.

(ii) Cost Neutral Early Retirement (CNER):

CNER is available to members of the Pension Scheme from 55 years of age. This facility enables teachers to retire earlier than the age at which they become entitled to the State Contributory Pension, but their benefits from the Pension Scheme are actuarially reduced by up to 36 percent for the rest of a retired teacher’s life.

(iii) Deferred Retirement:

Teachers who resign from teaching at an early age, and have at least 2 years pensionable service, can opt to defer taking their pension benefits until the age at which they are eligible to claim the State Contributory Pension, and so avoid paying penalties for early retirement.

(iv) Medical Retirement:

Teachers whose illness or disability means they are “permanently unfit to return to teaching” may apply for retirement on medical grounds. If granted, pensionable benefits are enhanced by the provision of additional referable amounts to those already generated by a member during their teaching career to date, up to a maximum of 10 times the value of the most recent full year contributions.

The continued payment of a pension to a teacher who has retired on medical grounds may be subject to medical review from time to time. In addition, teachers are not permitted to undertake comparable teaching work in retirement.

If you, or someone you know in your staffroom, may be a candidate for medical retirement please call the ASTI as soon as possible for advice. Our specialists can talk a teacher through the arrangements for long-term sick leave and options for medical retirement and assist, where necessary, in the preparation of an application for medical retirement.

More detailed information on medical retirement is available here.

How to Retire

Teachers have only been contributing to the Single Public Service Pension Scheme since 2013, and so far, few if any ASTI members have approached the age at which they would be considering retirement under the terms of this Pension Scheme. In any event, the same basic principles of preparing for retirement apply.

When you are looking to retire there are really three essential things you should do. Firstly you should apply to the administering authority for your Pension Scheme for an estimate of your pension benefits. Your administering authority is either the Department of Education & Skills (DES) or your Education and Training Board, i.e. the organisation that is responsible for paying your salary.

Secondly, you should also talk with a pension consultant about any private pension investments you may have made or may wish to make before you retire. Thirdly, when you have a solid understanding of the income you will be receiving in retirement, then and only then, should you make a formal application to retire from teaching. Deciding to retire from teaching is a momentous step as important as the decision you made to enter the teaching profession in the first place. You should prepare for your decision to retire with the same level of preparation you invested in your decision to join the profession.

Applying to Retire

Having decided to retire a teacher is required to give three months’ notice to their Board of Management, if employed in a Voluntary School, or one month’s notice if employed in a Community or Comprehensive School or by an Education & Training Board (ETB). If employed by an ETB, notice is given to the Chief Executive and copied to your Principal. A retiring teacher is also required to complete an official Retirement Application Form, copies of which are available in advance from the administering authority for your Pension Scheme, i.e. either the DES or ETB as appropriate.

Calculating your Pension and Lump Sum

Calculating your Pension Benefits

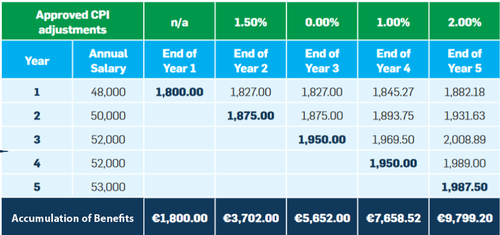

The Single Public Service Pension Scheme is a defined benefit scheme which applies across the public service. Members of the Single Public Service Pension Scheme make two separate contributions to the Pension Scheme every time they receive their salary. These regular payments are called ‘referable amounts’ with one going to build their retirement pension and the other to their retirement lump sum. Every year the value of accrued referable amounts held in the Scheme is uprated by the Consumer Price Index (CPI). Over the course of a teacher’s career these amounts build up and fund the defined pension benefits that the Scheme delivers on retirement. These benefits are co-ordinated with the State Contributory Pension and which is paid in addition to the retirement benefits delivered by your Pension Scheme. The following chart describes how benefits are built up in the Pension Scheme:

Scheme Estimator Tool

The Single Public Service Pension Scheme has provided an online tool to enable members of the Pension Scheme to calculate a rough estimate of their future pension benefits. The estimate provided by the tool is, of course, only as accurate as the quality of the information input to it. However, the Estimator Tool is useful for delivering a broad estimate of future pension benefits. The on-line Estimator Tool can be accessed here.

Enhancing your Pension

Enhancing Pension Benefits

Members of the Single Public Service Pension Scheme, who have been contributing to the Scheme for at least two years and have at least nine years left to retirement, can also purchase additional referable amounts on an annual cycle to enhance the value of their retirement benefits. A teacher applies to the Scheme administrators (DES or ETB) for a quote and, if accepted, the payments commence and continue for one full year. At the end of that year the additional referable amounts are banked in the Scheme. A teacher can repeat this cycle for up to 20 separate years in total. The value of these additional referable amounts ranks on a par with standard referable amounts when it comes to calculating retirement benefits, including the Spouses and Children’s Scheme, and their value is updated by the rate of inflation each year.

Spouses’ & Children’s Scheme

The Single Public Service Pension Scheme provides pension benefits for a teacher’s surviving spouse or civil partner and qualifying children in the event that a teacher dies either in service or in retirement. The benefits of the Scheme were extended to the spouses and children of same-sex marriages following the commencement of the Marriage Act 2015. The cost of survivors’ benefits is incorporated in the contribution that teachers make to the Pension Scheme every fortnight or month from their salary.

Benefits – Death in Service:

There are two benefits that may be payable should a teacher die while in teaching service, and providing they have been a member of the Scheme for at least 24 months. A death gratuity of up to twice the teacher’s pensionable salary earned in the previous year (expressed on a full-time basis) is payable on production of probate or letters of administration. The payment is made to the teacher’ personal representative, i.e. their executor (will) or administrator (no will). Thereafter, a survivor’s pension is payable to the spouse/civil partner. The value of the survivor’s pension is set at one-half of the pension that the deceased member would have earned had they retired on medical grounds at the date of death.

This pension is payable for the rest of the surviving spouse/civil partner’s life and will continue to be paid should the surviving spouse/civil partner remarry. If there is a pension adjustment order in effect, consequent on a divorce or judicial separation, the survivor’s pension will be paid in accordance with its terms. Separate arrangements apply for teachers who die in service but who have less than 24 months service.

Survivors’ pensions are also payable to dependent children until their 16th birthday, or until their 22nd birthday if they remain in full-time education. The value of the pension paid for a child is set at one-third of the surviving spouse/civil partner’s pension, up to three children. If there are more than three surviving children, the sum of these pensions is set at an equal amount to the spouse/civil partner’s pension distributed equally amongst the surviving children. A children’s pension is also payable to an adult dependent child, without age limit, who is permanently incapacitated providing the infirmity existed form birth or arise while the child was eligible for benefit.

Benefits – Death in Retirement

A teacher who dies in retirement will have already their received a pension gratuity when they retired. Survivors’ benefits, therefore, are limited to the pension paid to a surviving spouse/civil partner, and any qualifying children (see above).

More Information

A comprehensive booklet has been published by the Scheme which describes its key features.